The Ultimate Guide to Franchise Funding Options

When would an owner need franchise funding? There are times when attractive opportunities present themselves to business owners. Perhaps it’s the chance to upgrade to a new POS and order flow system so you can handle more customers. Maybe the franchisor has unveiled a new interior design, and you want to be among the first to move to it. It could even be the chance to buy an existing location in a nearby community. They’re all potentially great ideas … and all demand some level of franchise funding. So where should you turn for the capital you need?

Table of Contents

1. Traditional loan options for franchise funding

Traditional loan options for franchise funding

The first source many owners think about when it comes to franchise funding is their local bank. While it’s true commercial lenders appear to be eager to make loans, it’s often difficult for franchisees to qualify for affordable financing. For franchisees who do business through multiple locations in a large geographic area, the local bank may not have a large enough coverage area to meet all the needs. That may point the franchisee to large regional or national banks, but those rarely offer the highly personal service business owners prefer.

SBA loans for franchise financing

Because many franchise operations are considered to be small businesses, franchisees might consider Small Business Administration (SBA) loans. SBA loans are actually provided by banks, credit unions, and other financial institutions with federal backing. The SBA determines the interest rates, lending limits, and other key terms … and won’t approve loans for all of today’s franchise concepts, so make sure yours is eligible before you begin all the work associated with applying.

SBA loans have comparatively small lending limits

The SBA offers several different loan programs designed to provide working capital or finance the purchase of inventory and commercial equipment. The three most common types of SBA loans, each of which has different lending limits and standards, include:

-

- 7(a) loans – up to $5 million for working capital, refinancing, or purchase of furniture, fixtures, and supplies.

- 504 loans – up to $5.5 million for long-term fixed asset purchases like property.

- Microloans – up to $50,000 for working capital, inventory, supplies, equipment, and machinery.

Those loan limits may not be high enough for your franchise funding needs.

Advantages of SBA loans

The SBA program helps franchisees and other business owners who might have difficulty qualifying for loans on their own get access to the capital they need. The SBA's guarantee gives lenders an incentive to make loans they might otherwise reject. In addition, interest rates on these loans tend to be lower than comparable bank loans because of limits set by the SBA, and the repayment terms allow borrowers to get longer terms with lower monthly payments.

Disadvantages of SBA Loans

However, the disadvantages of borrowing through SBA loans may outweigh the benefits. Some of the obstacles franchise owners may face include:

-

- Credit qualifications. If your personal credit score is low, you may not qualify.

- Personal pledges. In addition to a pledge of business assets, the SBA typically requires a pledge of personal assets. Your home, for example. There’s also what’s known as a spousal guarantee, which means they can come after any of your spouse’s assets if you fail to pay.

- Cost. There may be a hefty down payment. Yes, you’ll have to pay them part of your working capital to borrow more of it.

- Slow process. The SBA approval process can take longer than other types of loans, and there may be delays in getting funds once the loan has been approved. You might even need to go through separate approval processes with the bank and SBA.

- Physical collateral. Bankers typically base their lending decisions on physical collateral such as real estate and inventory. As a result, when you want money to make an improvement they can’t visualize, they focus instead on how little your current business is worth. No matter how well-proven your concept may be, they’ll probably view your plans as pretty risky because they’ll have trouble understanding it.

Get Insights in Your Inbox

Franchise financing through alternative lenders

You might be surprised to learn that bank loans are just one of many ways to get the money your franchise business needs so you can grow. What are those options?

.png?width=600&height=500&name=Specialty%20Lending%20Options%20(1).png)

- Unsecured funding. This includes using credit cards to obtain the capital you need. Unsecured funding may be easier to obtain but generally carries higher interest rates.

- Crowdfunding, in which you post your needs on a website and interested individuals contribute funds.

- Family and Friends. They want to see you live your dream and help you get your feet on the ground. Are any of them retired business owners or executives? Ask them to become your advisor. But remember one very important thing: mixing relationships and business can get pretty messy.

- Equity. It’s a way of getting the funding you need by giving up part of your control or ownership. Your investor essentially becomes your business partner. And when the time comes to find even more funding, they’ll be happy to help, but they’ll expect a bigger piece of the pie in return.

- Private Equity. Some firms invest large amounts of money in promising companies in specific industries, including franchise businesses. They’re particularly attracted to franchises that are run effectively and profitably with a strong growth mindset. All they expect in return for their generosity is for their investment to grow immediately and aggressively.

- Minority Investors. As an alternative to the typical majority investment made by private equity, minority investors are on the rise as a capital option. They’ll expect to have a say in how you use the money and run your business, so it’s extremely important to ensure your objectives and those of the investor are aligned.

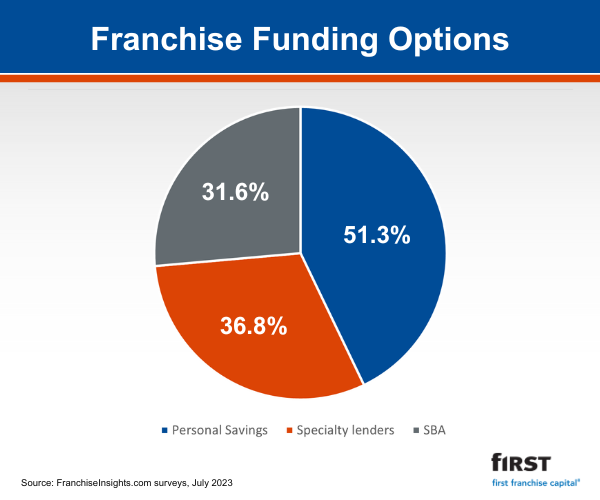

- Specialty lenders. There are companies like ours that have a single specialized purpose. For us, it’s lending to franchise owners. We know your world and the challenges you face.

→ Explore our Franchise Funding Options

Franchise financing mistakes to avoid

You may have noticed we didn’t include franchisors in that list. Many do offer financing, but that doesn’t guarantee you’ll receive the best rates or terms, and their franchise funding may come with painful restrictions. Before you sign any franchise financing agreement, be sure you’ve done your homework, considered all the options, and taken a long look at the best ones. If you’re getting ready to find the money you need to make your franchise funding plans a reality, be careful not to make these rookie mistakes:

Inadequate preparation

This isn’t like signing up for a credit card at a store. All business credit is complex in some ways, and before you begin the process, you need to make sure you understand how that process works. The better you understand it, the better you’ll be able to make the best choice. Specialty lenders like our team don’t drag their feet when making decisions about franchise loans, but there are regulatory processes that just can’t happen any faster. In other words, the process is probably going to take longer than you think, so you shouldn’t wait until the last minute.

Overlooking hidden costs

Capital isn’t free. Lenders and investors share a common goal: to make money. That’s how the system works. But capital can get confusing, and some less-scrupulous sources of money might neglect to mention extra fees and costs buried in the paperwork. Be sure you understand every detail about rates, fees, and terms before you sign anything.

Ignoring due diligence

Lenders conduct what’s known as due diligence to verify that everything you’ve stated is true and that you’ll be likely to repay whatever amount they approve. It’s also important for you to conduct your own due diligence about the lender, especially if you’ve never done business with them. You’ll want to make sure they’re legitimate, meet any compliance requirements, and have a reputation for treating borrowers well.

Underestimating working capital needs

Wishful thinking is a bad way to determine how much working capital your franchise plan will require. Don’t make the mistake of lowballing the amount you need because you think it will increase your chances for approval. Suppose you’re planning a major remodel of your location. If you use every penny of your working capital to fund it, you won’t be ready for unexpected emergencies or increases in the costs of materials. Calculate what you need carefully -- or work with experts who understand your plans -- and make sure you have a cushion to cover unexpected contingencies.

Choosing the right funding option for your franchise

As we noted earlier, you have plenty of options when seeking franchise funding, but that doesn't mean they're all equally appropriate for your business and your plans. That's why it's so important to explore those options carefully and ask questions to verify your understanding of what's involved. It's also worthwhile to reach out to trusted advisors like your attorney and CPA, because they may be able to point out issues you may not have considered. Doing that kind of homework may seem frustrating because it can slow down your plans, but it will increase the likelihood your funding choice allows you to achieve your goals with less stress and less negative impact on your franchise business.

First Franchise Capital does not make any representation as to the accuracy of materials presented in any webinar, whitepaper, vlog or blog, nor legal or financial information contained therein. Third party advertisements, links or presentations are not endorsements or recommendations by First Franchise Capital. Any materials presented are for informational purposes only. They are not offered as and do not constitute an offer for a loan, professional or legal advice or legal opinion by First Franchise Capital and should not be used as a substitute for obtaining professional or legal advice. The use of any materials, including sending an email, voice mail or any other communication to First Franchise Capital, does not create a relationship of any kind between you and First Franchise Capital.